Growing annuity formula excel

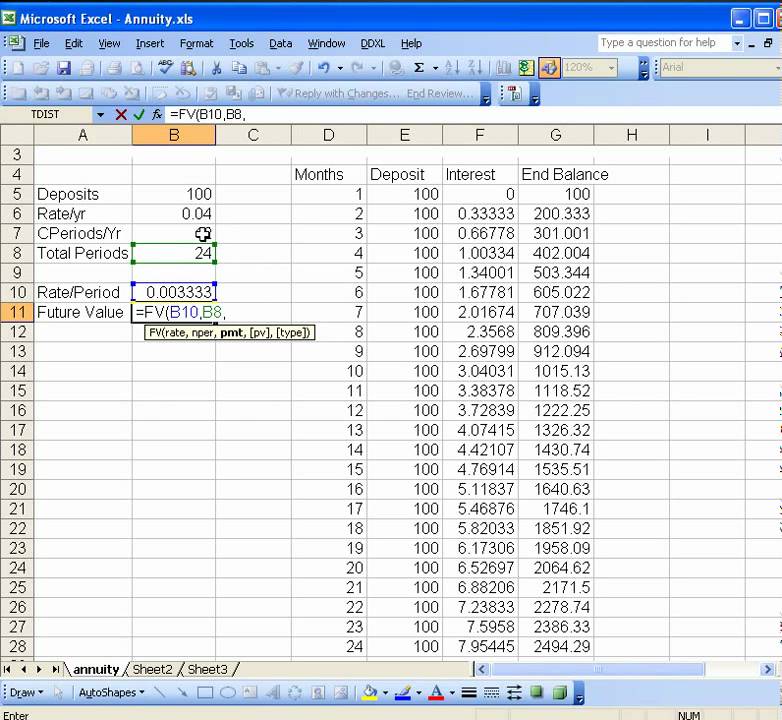

Step 2 Put the actual number into the formula. To calculate future value.

Future Value Of An Increasing Annuity Youtube

Present value of fgrowth perpetuity P i-g Where P.

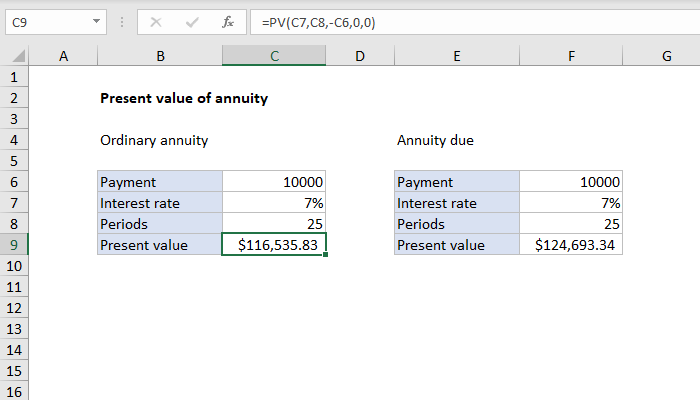

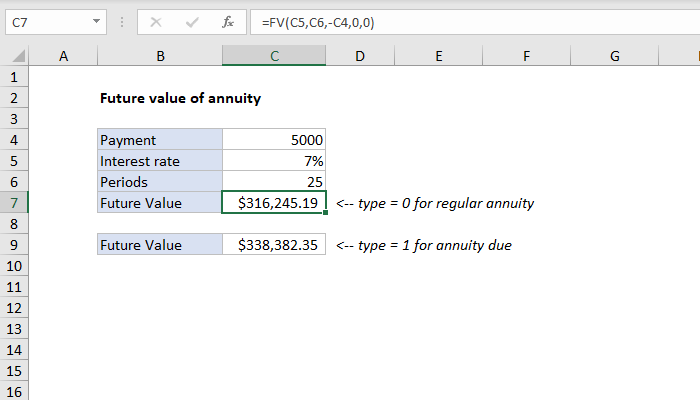

. The formula for Future Value of an Annuity formula can be calculated by using the following steps. In this example a 5000 payment is made each year for 25 years with an interest rate of 7. Calculating the present value of an annuity using Microsoft Excel is a fairly straightforward.

PMT Periodic payment. Calculating a Future Payment for a Growing Annuity. Future Value of a Growing Annuity Formula.

When you check the growing and initial cash flow at g make sure its sufficient. This would be considered a geometric series where 1g 1r is the common ratio. The basic annuity formula in Excel for present value is PV RATENPERPMT.

I Discount rate. The future value of a growing annuity can easily be calculated by checking out all the cash flows individually. In this equation the first payment C.

G growth rate. Let us look at an example of calculation of Present and Future value of an annuity. R interest rate.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Future Value of Annuity Due 600 1 6 10 1 1 6 6 Annuity Due Formula Example 2. If you were trying to figure out the present value.

Ad Learn More about How Annuities Work from Fidelity. PV Present Value. The payment at a future date can be calculated using the following formula.

When using this formula. FV is the value of a current asset at a future date based on an assumed. By using the geometric series formula the present value of a growing annuity will be shown as.

N number of periods. G Growth rate. C cash value of the first payment.

Step 1 To find the annual payment a rate of interest and growth rate of perpetuity. You can also use the FV formula to calculate other annuities such as a loan where you know your fixed payments the interest rate charged and the number of payments. N Number of periods.

Calculate your estimated interest earned over a select period of time demonstrating how a fixed single-premium deferred annuity may grow over the years. Firstly calculate the value of the future series of equal payments. An annuity is a series of equal cash flows spaced equally in time.

Present Value of a Growing Annuity Formula. PMT is the amount of each payment. Using the prior example in the first section an initial.

Ad Learn More about How Annuities Work from Fidelity.

Excel Formula Present Value Of Annuity Exceljet

Growing Annuity Formula With Calculator Nerd Counter

Growing Annuity Formula With Calculator Nerd Counter

Graduated Annuities Using Excel Tvmcalcs Com

Growing Annuity Formula With Calculator Nerd Counter

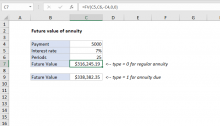

Excel Formula Future Value Of Annuity Exceljet

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Periodic Payment Archives Double Entry Bookkeeping

Graduated Annuities Using Excel Tvmcalcs Com

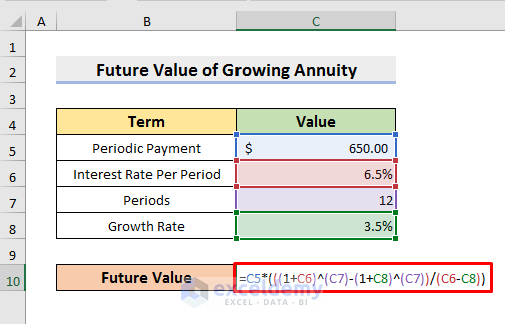

How To Calculate Future Value Of Growing Annuity In Excel

How To Calculate Future Value Of Growing Annuity In Excel

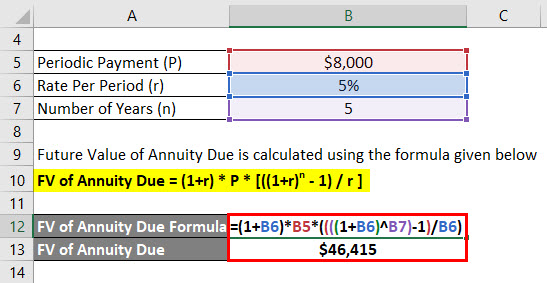

Future Value Of Annuity Due Formula Calculator Excel Template

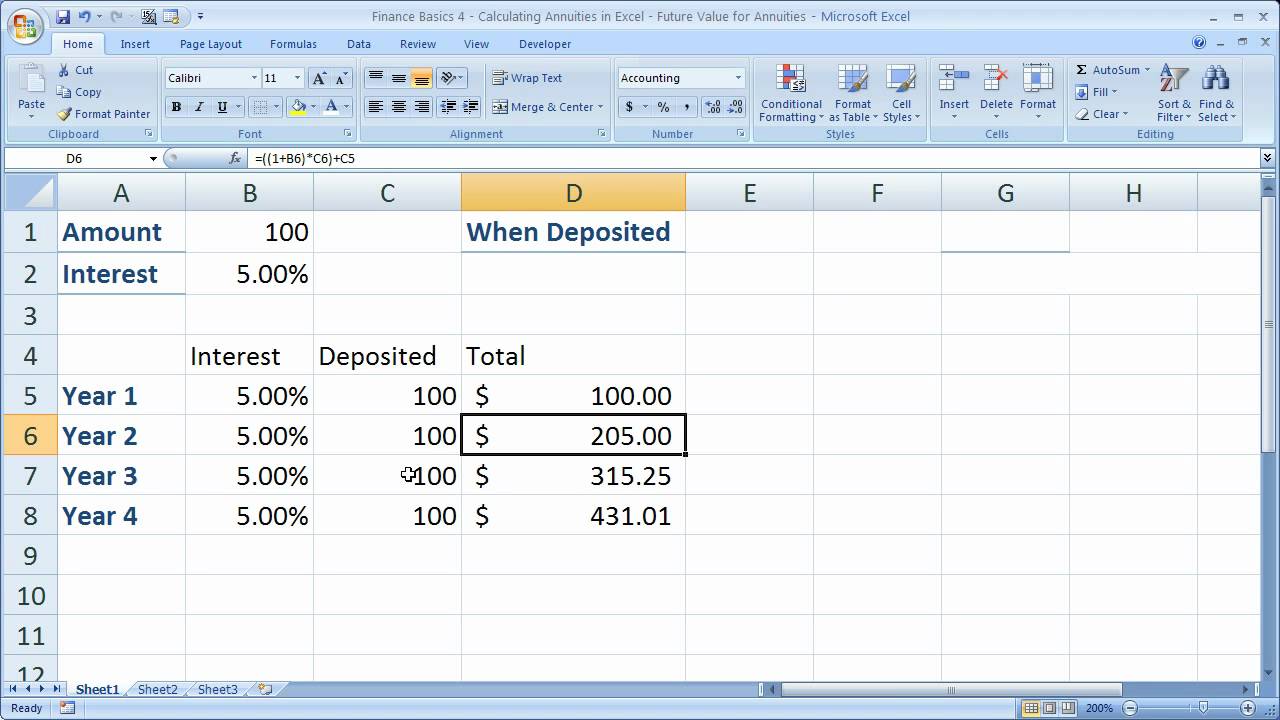

Finance Basics 4 Calculating Annuities In Excel Future Value For Annuities Youtube

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

Excel Formula Payment For Annuity Exceljet