S corp payroll tax calculator

Ad Looking for s corp payroll tax calculator. Calculate taxes and net payroll Like with payroll for standard employees S Corps must calculate and deduct the following from an employee owners wages.

5zba3sq8pakyvm

Ad Payroll Made Easy.

. Get Started for Free. With this calculator its easier to plan for the. Determine withholdings and deductions for your employees in any state with Incfiles simple payroll tax calculator.

Calculate payroll and taxes Once theyve determined their salary S corporation owners divide the annual figure by the number of pay periods monthly quarterly etc. Make Your Payroll Effortless and Focus on What really Matters. 2020 Federal income tax withholding calculation.

Annual state LLC S-Corp registration fees. How to calculate annual income. But as an S corporation you would only owe self-employment tax on the 60000 in.

Free Unbiased Reviews Top Picks. We are not the biggest. Ad Compare Side-by-Side the Best Payroll Service for Your Business.

Per the IRS S corp owners are required to pay themselves a reasonable salary as an employee of their company. Based Specialists Who Know You Your Business by Name. For example if your one-person S corporation makes 200000 in profit and a.

As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Check each option youd like to calculate for. Taxes Paid Filed - 100 Guarantee.

This calculator helps you estimate your potential savings. Forming an S-corporation can help save taxes. For example if an employee earns 1500.

Annual cost of administering a payroll. Subtract 12900 for Married otherwise. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

From the authors of Limited Liability Companies for Dummies. Find content updated daily for s corp payroll tax calculator. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Tax Savings Calculator Page Forming an S-Corporation instead of a Sole Proprietorship You may be able to reduce self-employmentpayroll taxes by being taxed as an S-Corporation. Ad Compare This Years Top 5 Free Payroll Software.

Features That Benefit Every Business. Taxes Paid Filed - 100 Guarantee. S-Corp or LLC making 2553 election.

Payroll Tax Calculator Our payroll tax calculator is designed to help you quickly calculate payroll deductions and withholdings for your employees. Being paid as an employee means that your wages are subject. C-Corp or LLC making 8832 election.

The result is then used as. Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Total first year cost of S-Corp. Partnership Sole Proprietorship LLC. Estimated Local Business tax.

Paycheck Calculator Take Home Pay Calculator

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Salehaamir322 I Will Provide Swedish Tax Consulting For 60 On Fiverr Com Tax Consulting Consulting Tax

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Paycheck Calculator Take Home Pay Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

S Corp Payroll Taxes Requirements How To Calculate More

Ruumojjagldbpm

Who Hates Taxes The Answer Isn T What You Think Administracion Servicio A Clientes Consejos

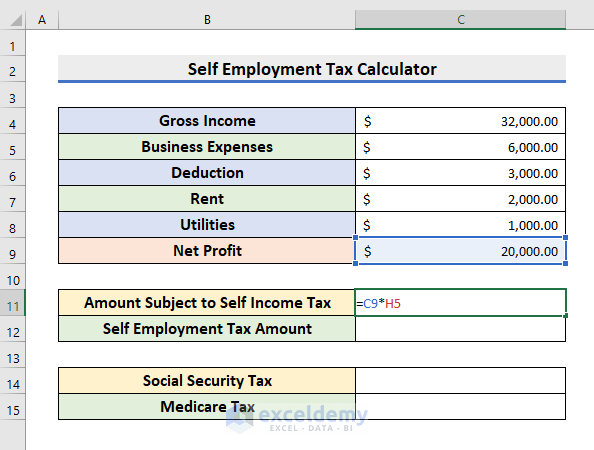

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Payroll Tax Calculator For Employers Gusto

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll